Premium wine growth hampered by big grocers, warns Rabobank

The growth of premium wines is being restricted by major grocers and tough economic conditions, despite more adventurous consumers seeking them out.

A new report from Rabobank into premium wine entitled "It's a long way to the top", warned that pricing growth in the UK has been deceptive, given "steady rises in government excise taxes". The report adds that the increasing prices has had the "unwelcome effect of dampening demand in the face of considerable economic headwinds".

However, a better picture was painted when it comes to the new generation of consumers coming into the wine drinking market. These have greater awareness of wine and wine quality than previous generations, and health messaging has made them more likely to "drink less, but higher quality wine". Higher education and income levels are also encouraging some consumers to "engage more deeply and differently with the category".

As more consumers become "increasingly adventurous", wines such as Prosecco and Marlborough Sauvignon Blanc "have duly presented some major threats to some very well-established wine styles".

The report says that this trend shows "fresh and vibrant wine brands and styles with a distinct point of difference are appealing to the less formal attitudes" modern consumers bring to wine.

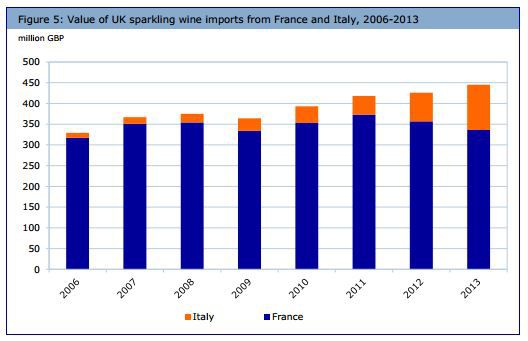

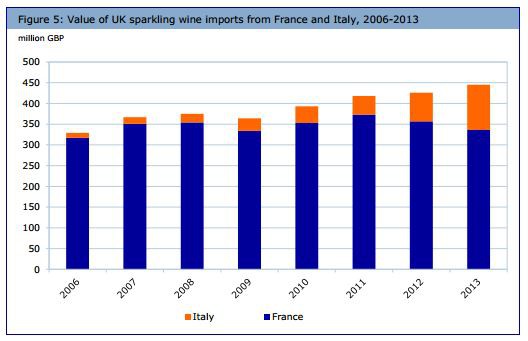

Rabobank maintains that while opportunities for premium wine growth are ripe, the market is hampered by challenges.Source: UIV, 2014

Rabobank maintains that while opportunities for premium wine growth are ripe, the market is hampered by challenges.Source: UIV, 2014

|

rabobank |

The dominance of the grocery retail market has been "growing in significance" globally, the report says, and "the structure of the channel has been changing in ways that leave less room for many premium wine producers". Instead bigger suppliers and stronger brands have "better-positioned" to capitalise on the growing demand for more premium wines.

While this is good news for some suppliers who are enhancing their connections with major wine companies to extend their premium credentials, others are ramping up private label wines. But many others are "finding themselves short of options of facing sustained pressure to either discount or lose their place" on shelf.

Online is offering greater potential, the report states, as independent operators with a lower cost-base than bricks-and-mortar competitors, can be nimble and through partnering with other smaller businesses can even "match the buying power of the major chains".

Looking at the on-trade, the report cites that "transformational change" is underway. Café wine bars account for more than half of all on-trade openings, and a bigger focus on food is matched with greater wine and spirit sales.

While it looks like consumers have an appetite for more premium wines, the report concludes that in only a few cases - such as the US and Canada - is this "translating into both higher consumption and higher prices with wine suppliers so desperately crave".