Kantar Worldpanel: Premium sales rise and Easter sales doubles market growth

Kantar Worldpanel figures show that premium sales have increased and market growth doubled posting the fastest growth since March of 2015, which may be good news for the wine category.

The figures cover the last 12 weeks ending on March 27, 2016.

Fraser McKevitt, the head of retail and consumer insight at Kantar Worldpanel said: "Premium sales are flying, up nearly 7% for all retailers combined."

Across the board retailers are winning customers through their premium offerings according to McKevitt. He said: "While saving money on the basics, consumers are not averse to treating themselves. Premium own label sales grew by 6.6% in the past 12 weeks, well ahead of the overall grocery market. Aldi and Lidl are leading the way, growing their premium lines more than twice as quickly as the rest of their ranges, but we've seen this across the retail spectrum - from Morrisons and The Co-operative to the likes of Waitrose, whose forthcoming launch of Waitrose 1 is the latest attempt by a traditional grocer to reclaim sales from the discounters."

This may be an opportunity for wine as a category as more consumers look to treat themselves and possibly even trade up and splurge for something a bit more premium.

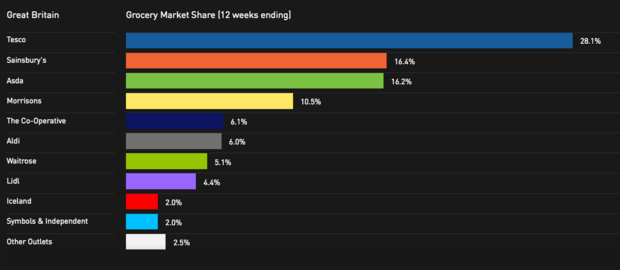

Kantar Worldpanel figures ending 27 March, 2016Grocery retailers market share

Kantar Worldpanel figures ending 27 March, 2016Grocery retailers market share

But while premium sales are rising and more consumers are willing to treat themselves, overall like-for-sales declined for the 20th consecutive period. "That in a nutshell is the retailer's conundrum. Consumers are willing to spend more money if the product is right, but not necessarily on everyday staples, with overall grocery prices falling yet again by 1.5%," explained McKevitt.

|

Grocery retailers market share |

Market growth, which doubled this month compared to last year, is a good sign but it is important to remember that Easter was also earlier this year which is helping to boost sales.

McKevitt said: "On the face of it market growth doubling to 1.1% is good news for the beleaguered supermarket sector. It is the fastest growth posted since March last year. However it is important to take into account this year's early Easter, which provides a 0.6% boost to sales when comparing to the same time last year when Easter was not included in the number."

Co-operative was a big winner over the last month. "Recording their fastest growth since the 2011 Somerfield acquisition, Co-operative growing 3.9%, edged their market share up to 6.1%. Co-operative growth has been rooted in their own label fresh food offer, which has helped increase the frequency of customer visits-echoing their strap line of 'little and often'," said McKevitt.

Lidl and Aldi have faired well and continue to expand in the UK market according to McKevitt. He said: "Growing even quicker are Lidl up 17.7% and Aldi up 14.4%. Aldi reached new record-high marketshare of 6.0% and the combined two discounters now account for 10.4% of the market."

Sainsbury's growth is in line with the market, while Tesco, Morrisons and Asda remain in decline.

|