Alcohol dominates list of top seven UK food and drink exports

Four out of the top seven performing export categories in the UK’s food and drink market are alcoholic, new figures have revealed.

New data released by the Food and Drinks Federation (FDF) covering the first half of 2017 shows that whisky has retained pole position as the UK’s number one food and drink export, despite dropping 1% by volume.

Other familiar faces include beer, wine and gin which have all retained their places in third, sixth and seventh places respectively.

Gin stayed in seventh place following on from 2016, with value sales reaching £235.1m - a 4% increase on H1 2016 (+£9.1m).

But wine exports are growing far more rapidly.

According to the figures, value wine exports were worth £273.8m in H1 2017, a rise of 21% compared to the same period last year (volume is also up by 15.4%.)

Overall, exports of UK food and drink in H1 2017 grew to £10.2bn, up 8.5% on H1 2016 – the largest H1 exports value on record.

Brexit likely played a part in this growth, the FDF said, with the fall in the price of the pound helping to boost UK export competitiveness in the EU and beyond.

However, at the same time, the weaker pound has also pushed up costs for British businesses that bring in food and raw materials from abroad.

Contrary to expectations, growth in food and drink sales was larger to EU countries than to countries outside the EU.

With sales to non-EU countries rising by 7.6%, sales rose by 9% to our European neighbours, prompting the FDF’s director general, Ian Wright CBE, to stress that the EU is still an “essential market” for the UK.

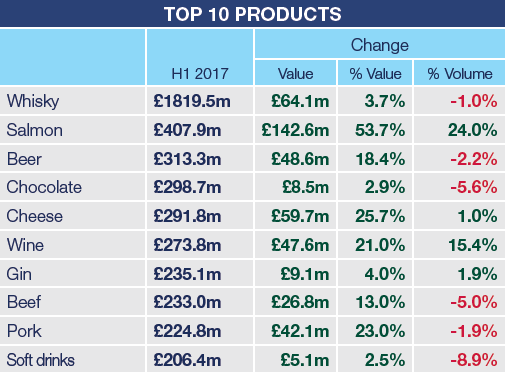

Top 10 products: H1 2017 export figures

Source: HM Customs and Excise

(H1 2017 shows total value sales for the category)

(Value shows increase on H1 2016)

Ireland, France and the US are the top three destinations for UK food and drink in terms of value, while the three export markets that saw the greatest percentage value growth were South Korea (+77%), China (+35%), and Belgium (+39%).

The US is the UK's top non-EU market for exports of branded food and drink.

But while the US chomped on bread, pastry, cakes, puddings and sweet biscuits, growth for drinks was particularly strong in East Asia, where profits surged to £156.3m propelled in particular by South Korea’s rapidly growing taste for British beer.

Wright commented: “The growth of food and alcoholic drink exports is very encouraging. We want to work with government to take advantage of increased demand for UK products overseas and the opportunities that leaving the EU is expected to create.

“We believe there are significant opportunities to grow our sector's exports further still. The continuing weakness of sterling is a concern. However, we hope that with the determination of businesses and the assistance of government, we can open more channels and provide a further boost to the UK's competitiveness on the world market.”

|

Top 20 Markets for UK food and drink exports H1 2017 |

||

|

|

H1 2017 |

Change |

|

Ireland |

£1765.4m |

12.4% |

|

France |

£1082.7m |

9.3% |

|

United States |

£1046.5m |

7.9% |

|

Netherlands |

£705.0m |

13.5% |

|

Germany |

£675.4m |

7.7% |

|

Spain |

£407.4m |

- 17.6% |

|

Belgium |

£341.9m |

39% |

|

China |

£274.3m |

35.3% |

|

Italy |

£267.0m |

6.9% |

|

Hong Kong |

£219.1m |

27.5% |

|

Australia |

£171.9m |

24.7% |

|

Poland |

£167.1m |

20.1% |

|

Denmark |

£166.0m |

13.7% |

|

United Arab Emirates |

£164.8m |

0.3% |

|

South Korea |

£156.3m |

77.0% |

|

Singapore |

£152.8m |

16.0% |

|

Canada |

£152.1m |

5.1% |

|

Sweden |

£145.4m |

10.4% |

|

Japan |

£110.1m |

- 1.9% |

|

Taiwan |

£95.0m |

0.4% |

Source: HM Customs and Excise