Average on-trade red bottle price rises £8 in a year thanks to premium upswing

Wine prices have seen significant upward movement in the on-trade, new research suggests, with red in particular receiving a generous boost from a rise in premium listings.

Thanks to a premium growth spurt on drinks lists, the average bottle of both red and white wines in UK bars and restaurants appears to be on the up, with the average listed price of a bottle of white wine now standing at £30.60 – an increase of £4 on a year ago.

The findings, from Wine Business Solutions’ 2018 UK on-premise report shows a 175ml glass of white wine costs, on average, £6.30 - up by more than a pound on last year, with white Burgundy being one of the biggest drivers of price growth.

However, the biggest growth appears to be coming from red wine, where the average bottle price in bars and restaurants is now £8 higher than December 2016/January 2017.

According to founder Peter McAtamney, “The overall average price hasn’t moved much due to large numbers of lesser Champagne brands being delisted in favour of the major brands. Most table wine categories have however shifted up in average listed price considerably.

“The average bottle of red wine on a UK wine list now costs £38.10, up a whopping £8 on 2017 due to more ultra-premium listings. The average glass of red costs £6.48, also up a pound on last year.”

Wine Business Solutions measures the success of countries of origin and average prices by analysing share of listings in a given market.

According to the report, the UK on-trade is in good health thanks to a significant in rise in prices, although much of the growth in premium listings is regionalised with London and the South overall faring much better than the North, Scotland and Northern Ireland.

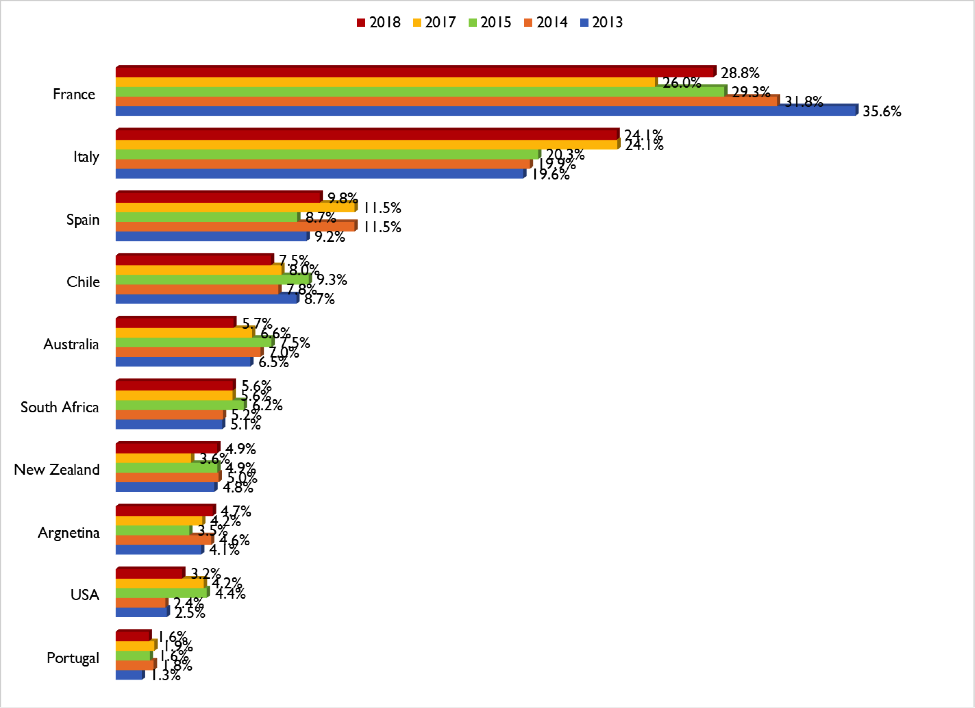

In terms of origin, France has clawed back some of its decline and now has 28.8% share – up from 26% this time a year ago.

Behind France is Italy, with a static 24.1% share of the UK on-trade.

In third place, McAtamney says Spain continues to "oscillate widely as it goes in and out of fashion from one year to the next.”

“As the market becomes more premium, somewhat predictably, it is Chile and Australia that have suffered most. South Africa is poised to overtake Australia in the UK on-premise.”

One country in particular which has benefitted from the premium upswing is New Zealand, which has managed a significant turnaround led by quality brands.

According to the data, Marlborough’s St Clair is now the most listed table wine brand in the UK.

Wine Business Solutions: UK on-trade share of listings by country of origin

Keywords:

- wine

- UK

- growth

- price

- red

- premium

- year

- listings

- average

- bottle

- premium listings

- average bottle

- table wine

- average listed

- red wine

- average listed price

- ”wine business solutions

- year ”wine business

- last year ”wine

- ultra premium listings